| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 14A |

| |

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) |

|

| Filed by the Registrant [X] |

| |

Filed by a Partyparty other than the Registrant [ ] |

| |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

| |

| CHROMADEX CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

ChromaDex Corporation

10005 Muirlands10900 Wilshire Blvd, Suite G600

Irvine,Los Angeles, CA 9261890024

NOTICE OF 20162020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 2, 201619, 2020

April 12, 201621, 2020

To the stockholders of ChromaDex Corporation:

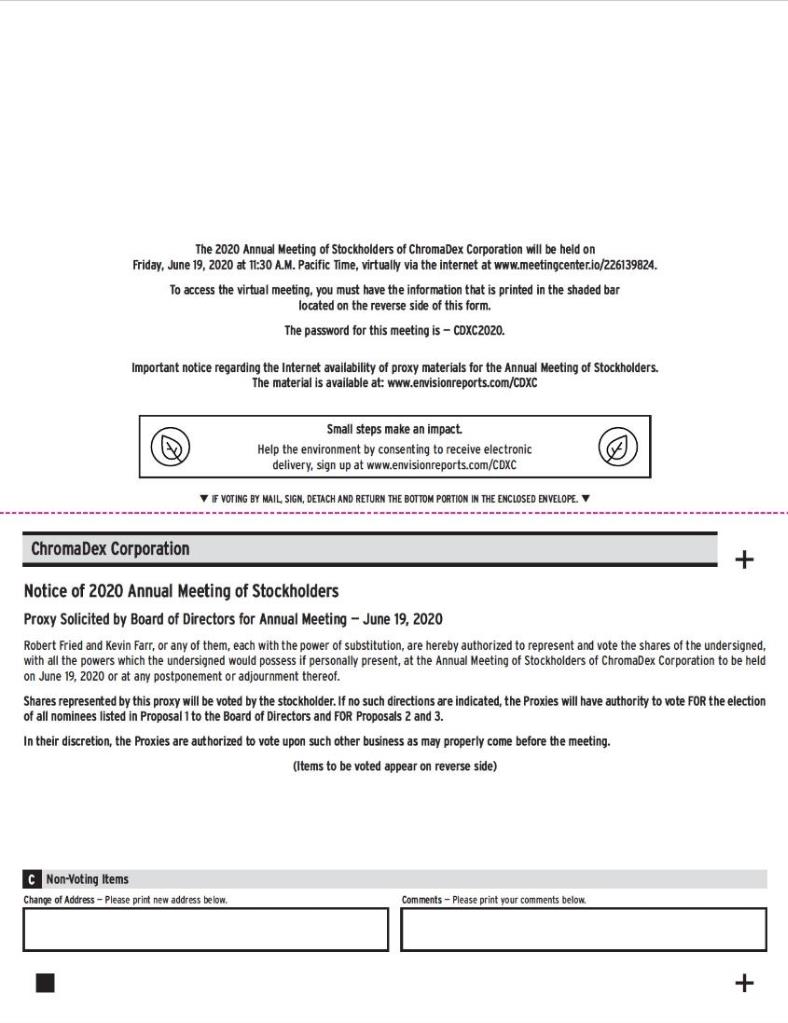

Notice is hereby given that the 20162020 Annual Meeting of Stockholders (the “Annual Meeting”) of ChromaDex Corporation, a Delaware corporation (the(“we,” “us,” “our,” “ChromaDex,” or the “Company”), will be held on June 2, 2016,19, 2020, at 9:00 am local time, at 10005 Muirlands Blvd, Suite G, Irvine, CA 92618 for11:30 a.m. Pacific Time. You are being asked to vote on the following purposes, as more fully described in the accompanying proxy statement (the “Proxy Statement”):matters:

| (1) | To elect seven directors;the eight nominees for director named herein; |

| (2) | (2)To approve an amendment to the Company’s 2017 Equity Incentive Plan, as amended, to, among other things, increase the aggregate number of shares of common stock authorized for issuance under such plan by 5.5 million shares;

|

| (3) | To ratify the appointment of Marcum LLP as the Company'sCompany’s independent registered public accounting firm for the year ending December 31, 2016; |

(3)

| To authorize the adjournment of the Annual Meeting if necessary or appropriate, including to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting or adjournment or postponement thereof to approve any of the foregoing proposals;2020; and

|

| (4) | To transact other business that may properly come before the meeting and any postponement(s) or adjournment(s) thereof. |

The accompanying proxy statement contains additional information and should be carefully reviewed by stockholders.

Because of the COVID-19 pandemic, the Annual Meeting will be a completely virtual meeting of stockholders, conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online and vote your shares electronically by visiting: www.meetingcenter.io/226139824 at the meeting date and time described in the accompanying proxy statement. The password for the meeting is CDXC2020. There is no physical location for the Annual Meeting. We are utilizing the latest technology to provide safe access for our stockholders. Hosting a virtual meeting will enable greater stockholder attendance and participation from any location. Questions related to the Annual Meeting or voting matters can be submitted by email toInvestorRelations@Chromadex.com. We encourage you to attend online and participate. We recommend that you log in a few minutes before the Annual Meeting start time of 11:30 a.m. Pacific Time on June 19, 2020, to ensure you are logged in when the Annual Meeting begins. Pursuant to the bylaws of the Company, the Board of Directors has fixed the close of business on April 8, 201620, 2020 as the record date (the “Record Date”) for determination of stockholders entitled to notice and to vote at the Annual Meeting and any adjournment thereof. Holders of the Company’s Common Stock are entitled to vote at the Annual Meeting.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our beneficial owners and stockholders of record access to our proxy materials over the Internet. Beneficial owners are stockholders whose shares are held in the name of a broker, bank or other agent (i.e., in “street name”). Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about April 15, 201627, 2020 to our beneficial owners and stockholders of record who owned our Common Stock at the close of business on April 8, 2016.20, 2020. Beneficial owners and stockholders of record will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions in the Notice. Beneficial owners and stockholders of record who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials instead of a Notice.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote your shares by promptly completing, signing and returning the enclosed proxy card using the enclosed envelope. The enclosed envelope requires no postage if mailed within the United States. You may also vote your shares over telephone or the internet in accordance with the instructions on the proxy card. Any stockholder attending the Annual Meeting may vote in person, even if you have already returned a proxy card or voting instruction card.

| BY ORDER OF THE BOARD OF DIRECTORS/s/ Stephen AllenFrank L. Jaksch Jr. Executive Chairman of the Board |

| | |

| Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder. | |

| | |

TABLE OF CONTENTS

| Introduction | 1 |

| |

| Questions and Answers About these Proxy Materials and Voting | 2 |

| |

| Proposal 1: Election of Directors | 7 |

| |

| Information Regarding the Board of Directors and Corporate Governance | 11 |

| |

| Proposal 2: Approval of an Amendment to the 2017 Equity Incentive Plan | 16 |

| |

| Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm | 29 |

| |

| Executive Officers | 30 |

| |

| Executive Officers and Management Compensation | 31 |

| |

| Certain Relationships and Related Transactions | 46 |

| |

| Security Ownership of Certain Beneficial Owners and Management | 48 |

| |

| Householding of Proxy Materials | 50 |

| |

| Other Business | 51 |

| |

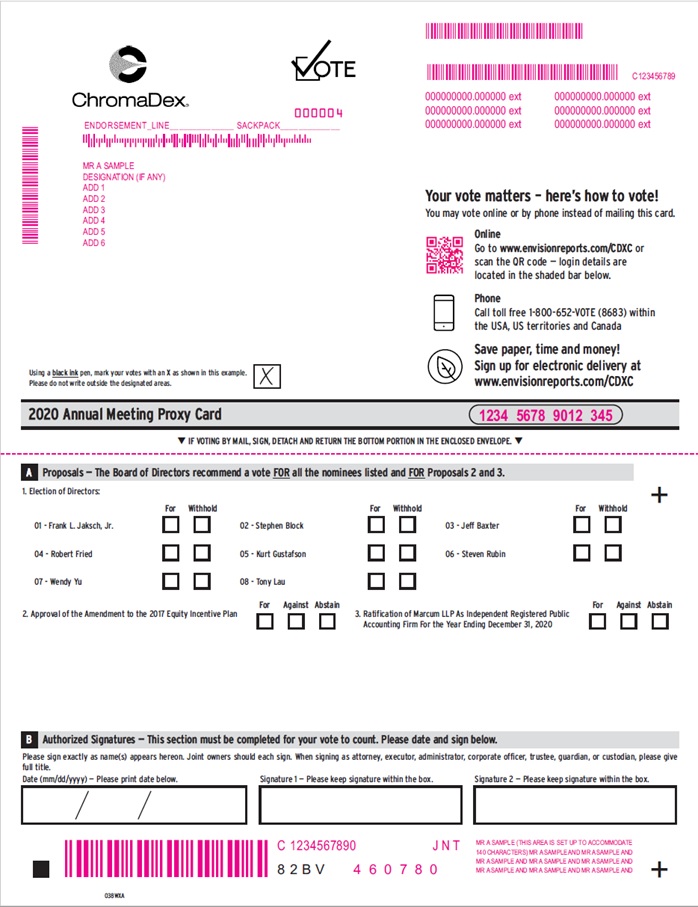

| Proxy Card | 52 |

| |

| Appendix A – ChromaDex Corporation Amended 2017 Equity Incentive Plan | A-1 |

ChromaDex Corporation

10005 Muirlands10900 Wilshire Blvd, Suite G600

Irvine,Los Angeles, CA 9261890024

PROXY STATEMENT

FOR

20162020 ANNUAL MEETING OF STOCKHOLDERS

JUNE 2, 201619, 2020

INTRODUCTION

The enclosed proxy is solicited by the boardBoard of directorsDirectors (“Board of Directors” or “Board”) of ChromaDex Corporation (the “Company”), in connection with the 20162020 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company, to be held on June 2, 2016,19, 2020, at 9:00 am local time,11:30 a.m. Pacific Time via live webcast at 10005 Muirlands Blvd, Suite G, Irvine, CA 92618.

www.meetingcenter.io/226139824 due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our stockholders, employees, management and directors.

At the Annual Meeting, you will be asked to consider and vote upon the following matters:

| (1) | To elect seven directors;the eight nominees for director named herein; |

| (2) | (2)To approve an amendment to the Company’s 2017 Equity Incentive Plan, as amended, to, among other things, increase the aggregate number of shares of common stock authorized for issuance under such plan by 5.5 million shares;

|

| (3) | To ratify the appointment of Marcum LLP as the Company's independent registered public accounting firm for the year ending December 31, 2016; |

(3) | To authorize the adjournment of the Annual Meeting if necessary or appropriate, including to solicit additional proxies in the event that there are not sufficient votes at the time of the Annual Meeting or adjournment or postponement thereof to approve any of the foregoing proposals;2020; and

|

(4) | To transact other business that may properly come before the meeting and any postponement(s) or adjournment(s) thereof. |

The Board of Directors has fixed the close of business on April 8, 201620, 2020 as the record date (the “Record Date”) for determining stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide our beneficial owners and stockholders of record access to our proxy materials over the Internet. Beneficial owners are stockholders whose shares are held in the name of a broker, bank or other agent (i.e., in “street name”). Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed on or about April 15, 201627, 2020 to our beneficial owners and stockholders of record who owned our Common Stock at the close of business on April 8, 2016.20, 2020. Beneficial owners and stockholders of record will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials be sent to them by following the instructions in the Notice. Beneficial owners and stockholders of record who have previously requested to receive paper copies of our proxy materials will receive paper copies of the proxy materials instead of a Notice.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 2, 2016:19, 2020: THE NOTICE, PROXY STATEMENT, PROXY CARD AND THE ANNUAL REPORT ARE AVAILABLE ATWWW.CHROMADEX.COM, INVESTOR RELATIONS SECTION.

QUESTIONS AND ANSWERS ABOUT THISTHESE PROXY MATERIALMATERIALS AND VOTING

Why did I Receivereceive in the Mailmail a Notice of Internet Availability of Proxy Materials this Yearyear instead of a Full Setfull set of Proxy Materials?

We are pleased to take advantage of the SEC rule that allows companies to furnish their proxy materials over the Internet. Accordingly, we have sent to our beneficial owners and stockholders of record a Notice of Internet Availability of Proxy Materials. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice. Our stockholders may request to receive proxy materials in printed form by mail or electronically on an ongoing basis. A stockholder’s election to receive proxy materials by mail or electronically by email will remain in effect until the stockholder terminates its election.

Why did I Receive a Full Set of Proxy Materials inWe intend to mail the Mail instead of a Notice of Internet Availability of Proxy Materials?

We are providing paper copies of the proxy materials instead of a Noticeon or about April 27, 2020 to our beneficial owners orall stockholders of record who have previously requestedentitled to vote at the Annual Meeting.

Will I receive paper copiesany other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 7, 2020.

How can I attend the Annual Meeting?

In light of the COVID-19 pandemic, to support the health and well-being of our stockholders, employees and directors, and taking into account recent federal, state and local guidance, the Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held. You will be able to attend the Annual Meeting online by visiting www.meetingcenter.io/226139824. You also will be able to vote your shares online by attending the Annual Meeting by webcast. Questions related to the Annual Meeting or voting matters can be submitted by email to InvestorRelations@Chromadex.com.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. The password for the meeting is CDXC2020. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 11:30 a.m., Pacific Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a beneficial ownerregistered stockholder (i.e., you hold your shares through our transfer agent, Computershare Trust Company, N.A.), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or stockholder of record who received a paper copy ofproxy card that you received. Registered stockholders can attend the meeting by accessing the meeting site at www.meetingcenter.io/226139824 and entering the 15-digit control number that can be found on your Notice or proxy card mailed with the proxy materials and you would like to reduce the environmental impact and the costs incurred by us in mailing proxy materials, you may elect to receive all future proxy materials electronically via email or the Internet.meeting password, CDXC2020.

You can chooseIf you hold your shares through an intermediary, such as a bank or broker, you must register in advance to receive future proxy materials electronically by sending an electronic mail message to proxy@equitystock.com or call 212-575-5757. Your choice to receive proxy materials electronically will remain in effect until you instruct us otherwise.

The SEC has enacted rules that permit us to make available to stockholders electronic versions of the proxy materials even if the stockholder has not previously elected to receive the materials in this manner. We have chosen this option in connection withattend the Annual Meeting virtually on the Internet. To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your ChromaDex Corporation holdings along with respect to both our beneficial ownersyour name and stockholders of record.

I Share an Address with Another Stockholder, and We Received Only One Paper Copy of the Proxy Materials. How May I Obtain An Additional Copy of the Proxy Materials?

The Company has adopted a procedure called “householding,” which the SEC has approved. Under this procedure, the Company is delivering a single copy of the Notice to multiple stockholders who share the same address unless the Company has received contrary instructions from one or more of the stockholders. This procedure reduces the Company’s printing and mailing costs, and the environmental impact of the Company’s annual meetings. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, the Company will deliver promptly a separate copy of the Notice and other Proxy Materials to any stockholder at a sharedemail address to which the Company deliveredComputershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 16, 2020. You will receive a single copyconfirmation of any of these documents.your registration by email after we receive your registration materials.

To receive a separate copy of the Notice, stockholders may write or speakRequests for registration should be directed to the Companyus at the following address and phone number:following:

By email

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail

Computershare

ChromaDex Corporation Legal Proxy

10005 Muirlands Blvd, Suite GP.O. Box 43001

Irvine, CA 92618

Attention: Corporate Secretary

Telephone: 949-419-0288Providence, RI 02940-3001

Stockholders who hold shares in “street name” (as described below) may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Who Is Entitled to Vote?can vote at the Annual Meeting?

Our Board has fixedOnly stockholders of record at the close of business on April 8, 2016 as the Record Date for a determination of stockholders20, 2020 will be entitled to notice of, and to vote at the Annual Meeting or any adjournment thereof. Each shareMeeting. On this record date, there were 59,787,897 shares of the Company’s common stock represents, one vote that may be voted on each proposal that may come before the Annual Meeting (the “Voting Capital”). On the Record Date, there were 109,658,547 shares of Common Stock outstanding. outstanding and entitled to vote.

What Is the Difference Between HoldingStockholder of Record: Shares as a Record Holder and as a Beneficial Owner (Holding SharesRegistered in Street Name)?Your Name

If on April 20, 2020 your shares arewere registered directly in your name with ourthe Company’s transfer agent, Equity Stock Transfer,Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted. Registered stockholders can attend the meeting by accessing the meeting site at www.meetingcenter.io/226139824 and entering the 15-digit control number that can be found on your Notice or proxy card mailed with the proxy materials and the meeting password, CDXC2020.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 20, 2020 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the “record holder”beneficial owner of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have beenname” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As thea beneficial owner, you have the right to instruct this organization ondirect your broker or other agent regarding how to vote the shares in your shares.

Who May Attend the Meeting?

Record holders and beneficial owners mayaccount. You are also invited to attend the Annual Meeting. IfHowever, since you are not the stockholder of record, you may not vote your shares are held in street name,at the meeting unless you will need to bringrequest and obtain a copy of a brokerage statementvalid proxy from your broker or other documentation reflecting your stock ownershipagent.

What am I voting on?

There are three matters scheduled for a vote:

●

To elect the eight nominees for director named herein;

●

To approve an amendment to the 2017 Equity Incentive Plan, as amended, to, among other things, increase the number of authorized shares for issuance under such plan by 5.5 million shares; and

●

To ratify the appointment of Marcum LLP as the Company's independent registered public accounting firm for the year ending December 31, 2020.

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the Record Date.persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How Do I Vote?

StockholdersYou may either vote “For” all the nominees to the Board of RecordDirectors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

For your convenience, our record holders have four methodsThe procedures for voting are fairly simple:

Stockholder of voting:

| 1. Vote by Internet. The website address for Internet voting is on your vote instruction form.

2. Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States).

3. Vote by telephone. You may vote by proxy by calling the toll free number found on the vote instruction form.

4. Vote in person. Attend and vote at the Annual Meeting.

|

| | |

Beneficial Owners ofRecord: Shares HeldRegistered in StreetYour Name

ForIf you are a stockholder of record, you may vote at the Annual Meeting or vote by proxy using the enclosed proxy card. Alternatively, you may vote by proxy either by telephone or on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your convenience, our beneficial ownersvote is counted. You may still attend the meeting and vote even if you have four methods of voting:already voted by proxy.

| 1. Vote by Internet. The website address for Internet voting is on your vote instruction form.● To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. ● To vote over the telephone, dial toll-free 1-800-652-VOTE (8683) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 5:00 p.m., Eastern Time on June 18, 2020 to be counted. ● To vote through the internet, go to www.envisionreports.com/CDXC to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 5:00 p.m., Eastern Time on June 18, 2020 to be counted. ● To vote during the Annual Meeting, follow the instructions posted at www.meetingcenter.io/226139824. 2. Vote by mail. Mark, date, sign and mail promptly your vote instruction form (a postage-paid envelope is provided for mailing in the United States).

3. Vote by telephone. You may vote by proxy by calling the toll free number found on the vote instruction form.

4. Vote in person. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Annual Meeting.

|

| | |

If you vote by Internet or by telephone, please DO NOT mail your proxy card.

All

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares entitledregistered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from the Company. Simply follow the voting instructions in the Notice to ensure that your vote and represented by a properly completed and executed proxy received before the meeting and not revoked will be votedis counted. To vote at the Annual Meeting, as you instruct inmust obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy delivered beforeform.

What if I have technical difficulties or trouble accessing the virtual Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please click on the “Support” link in the upper right of the broadcast screen to access: https://support.vevent.com. Technical support will be available starting at 9:00 a.m. Pacific Time on June 19, 2020.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 20, 2020.

What happens if I do not indicate howvote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or at the Annual Meeting, your shares shouldwill not be votedvoted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a matter,“routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares represented byon Proposal 1 or Proposal 2 without your properly completedinstructions, but may vote your shares on Proposal 3 even in the absence of your instruction.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and executeddated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the Board recommends on eachelection of all eight nominees for director, “For” the enumerated proposals proposal to approve an amendment to the 2017 Equity Incentive Plan, as amended, to, among other things, increase the number of authorized shares for issuance under such plan by 5.5 million shares, and with regard“For” the proposal to ratify the appointment of Marcum LLP as the Company's independent registered public accounting firm for the year ending December 31, 2020. If any other matters that may bematter is properly presented at the Annual Meetingmeeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all matters incident toof your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the conduct offinal vote at the meeting. If you are a registered stockholder and attend the meeting,record holder of your shares, you may deliverrevoke your proxy in any one of the following ways:

●

You may submit another properly completed proxy card with a later date.

●

You may grant a subsequent proxy by telephone or through the internet.

●

You may send a timely written notice that you are revoking your proxy to the Company’s Secretary at 10900 Wilshire Blvd. Suite 600, Los Angeles, CA 90024.

●

You may vote during the Annual Meeting which will be hosted via the Internet.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in person. “Street name” stockholders whothe Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

To be considered for inclusion in the Company’s proxy materials for next year’s annual meeting, your proposal must be submitted in writing by December 28, 2020, to ChromaDex Corporation, Attn: Secretary, at 10900 Wilshire Blvd. Suite 600, Los Angeles, CA 90024. If you wish to votesubmit a proposal (including a director nomination) at the annual meeting will needthat is not to obtain abe included in the Company’s proxy form frommaterials for next year’s annual meeting, such proposal must be received no earlier than the institution that holds their shares. Allclose of business on March 21, 2021 nor later than the close of business on April 20, 2021. You are also advised to review the Company’s Bylaws, which contain additional requirements relating to advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be tabulatedcounted by the inspector of electionselection appointed for the meeting, who will separately tabulate affirmative and negativecount, for the proposal to elect directors, votes abstentions“For,” “Withhold” and broker non-votes.non-votes; and, with respect to Proposal 2 and Proposal 3, votes “For” and “Against,” and abstentions. Abstentions will be counted towards the vote total for Proposal 2 and Proposal 3 and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

Is My Vote Confidential?What are “broker non-votes”?

Yes, your vote is confidential. Only the following persons have access to your vote: the inspectorAs discussed above, when a beneficial owner of elections, individuals who help with processing and counting your votes, and persons who need access for legal reasons. Occasionally, stockholders provide written comments on their proxy cards, which may be forwardedshares held in “street name” does not give instructions to the Company’s management andbroker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How Many Votes Are Needed for Each Proposal to Pass?

| Proposal | | Vote Required for Approval | | Effect of Abstention | | Effect of Broker Non-Vote |

| | | | | | |

Election of eight members to our Board of Directors | | Plurality of the votes cast (the eight directors receiving the most “For” votes) | | None. | | None. |

| Approval of an amendment to the 2017 Equity Incentive Plan, as amended, to, among other things, increase the number of authorized shares for issuance under such plan by 5.5 million shares | | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | | Against. | | None. |

Ratification of the Appointment of Marcum LLP as our Independent Registered Public Accounting Firm for our Fiscal Year Ending December 31, 2020 | | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter | | Against. | | None. |

Vote cast online during the virtual Annual Meeting will constitute votes cast in person at the Annual Meeting for purposes of Directors.the votes.

What Constitutes a Quorum?

To carry on business at the Annual Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of a quorum at the meeting. Thus, holders of the Voting Capital representing at least 54,829,274 29,893,949 votes must be represented in person or by proxy to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, our stockholders may adjourn the meeting.

What is a Broker Non-Vote?

If your shares are held in street name, you must instruct the organization who holds your shares how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any non-routine proposal. This vote is called a “broker non-vote.” If you sign your proxy card but do not provide instructions on how your broker should vote, your broker will vote your shares as recommended by our Board. Broker non-votes are not included in the tabulation of the voting results of any of the proposals and, therefore, do not effect these proposals.

For the ratification of the appointment of Marcum LLP, brokers can use discretionary authority to vote shares. However, brokers cannot use discretionary authority to vote shares on the proposal to elect directors at the Annual Meeting if they have not received instructions from their clients. Please submit your vote instruction form so your vote is counted.

Which Proposals Are Considered “Routine” or “Non-Routine”?

Proposal 2, the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016 is considered routine. Proposal 1, the election of seven directors is considered non-routine.

What is an Abstention?

An abstention is a stockholders affirmative choice to decline to vote on a proposal. Abstentions are not included in the tabulation of the voting results of any of the proposals and, therefore, do not affect these proposals.

How Many Votes Are Needed for Each Proposal to Pass?

Proposal | | Vote Required | | Broker

Discretionary

Vote Allowed

|

| | | | |

Election of seven (7) members to our Board of Directors

| | Plurality of the votes cast (the seven directors receiving the most “For” votes)

| | No |

Ratification of the Appointment of Marcum LLP as our Independent Registered Public Accounting Firm for our Fiscal Year Ending December 31, 2016

| | A majority of the votes cast | | Yes |

What Are the Voting Procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. With regard to the ratification of the appointment of Marcum LLP, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

All shares represented by proxy will be voted at the Annual Meeting in accordance with the choices specified on the proxy, and where no choice is specified, in accordance with the recommendations of the Board of Directors. Thus, where no choice is specified, the proxies will be voted for the election of directors and for the ratification of the appointment of an independent registered public accounting firm.

Is My Proxy Revocable?

You may revoke your proxy and reclaim your right to vote at any time before it is voted by giving written notice to the Secretary of the Company, by delivering a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: ChromaDex Corporation, 10005 Muirlands Blvd, Suite G, Irvine, CA 92618, Attention: Secretary.

Who Is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing.

Do I Have Dissenters’ Rights of Appraisal?

The Company’s stockholders do not have appraisal rights under Delaware law or under the governing documents of the Company with respect to the matters to be voted upon at the Annual Meeting.

How can I find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, which we will file within four business days of the meeting.

What Is the Deadline to Propose Actions for Consideration or to Nominate Individuals to Serve as Directors at the 2017 Annual Meeting?PROPOSAL 1:

ELECTION OF DIRECTORS

Requirements for Stockholder ProposalsEach director to Be Considered for Inclusionbe elected at the Annual Meeting will serve until the next annual meeting of stockholders and until his or her successor is elected, or, if sooner, until such director’s death, resignation or removal. Unless otherwise instructed, the persons named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the eight nominees listed below. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in such event, proxies will be voted by the proxy holder for such other persons as may be designated by the Board of Directors, unless the Board of Directors reduces the number of Directors to be elected. Election of a director to the Board of Directors requires a plurality of the votes cast at the Annual Meeting.

The current Board of Directors consists of Frank Jaksch, Jr., Stephen Block, Jeff Baxter, Robert Fried, Kurt Gustafson, Steven Rubin, Wendy Yu and Tony Lau. The Board of Directors has determined that a majority of its members, including Stephen Block, Jeff Baxter, Kurt Gustafson, Steven Rubin, Wendy Yu and Tony Lau are independent directors within the meaning of the applicable NASDAQ rules.

The following table sets forth the director nominees. It also provides certain information about the nominees as of the Record Date.

Nominees for Election to Board of Directors

| | | | | Director |

| Name | | Age | | Since |

| Frank Jaksch, Jr. | | 51 | | 2000 |

| Stephen A. Block | | 75 | | 2007 |

| Jeff Baxter | | 58 | | 2015 |

| Robert Fried | | 60 | | 2015 |

| Kurt Gustafson | | 52 | | 2016 |

| Steven Rubin | | 59 | | 2017 |

| Wendy Yu | | 44 | | 2017 |

| Tony Lau | | 31 | | 2017 |

Frank L. Jaksch Jr., 51, is a Co-Founder of the Company and has served as a member of the Board since February 2000. Mr. Jaksch served as Chairman of the Board from May 2010 to October 2011 and was its Co-Chairman from February 2000 to May 2010. In June 2018, Mr. Jaksch transitioned from Chief Executive Officer to Executive Chairman of the Board. Mr. Jaksch oversees research, strategy and operations for the Company with a focus on scientific and novel products for pharmaceutical and nutraceutical markets. From 1993 to 1999, Mr. Jaksch served as International Subsidiaries Manager of Phenomenex, a life science supply company where he managed the international subsidiary and international business development divisions. Mr. Jaksch earned a B.S. in Chemistry and Biology from Valparaiso University. The Nominating and Corporate Governance Committee believes that Mr. Jaksch’s years of experience working in chemistry-related industries, his extensive sales and marketing background, and his knowledge of international business bring an understanding of the industries in which the Company operates as well as scientific expertise to the Board.

Stephen A. Block, 75, has been a director of the Company since October 2007 and Chair of the Compensation Committee and a member of the Audit Committee since October 2007. From May 2010 to October 2011, Mr. Block served as Lead Independent Director to the Board. Until November 2018, when Senomyx, Inc. was sold to Firmenich, Inc., an unaffiliated third party, Mr. Block was a director and chair of the nominating and corporate governance committee and a member of the audit committee of Senomyx, Inc., where he had served on the board of directors since 2005. He also is, and since September 2015 has been, a director of myLAB Box, Inc., a privately held company. Until December 2011, he also served as the chairman of the board of directors of Blue Pacific Flavors and Fragrances, Inc., and, until March 2012, as a director of Allylix, Inc. He served on the boards of directors of these privately held companies since 2008, and 2007, respectively. Mr. Block retired as senior vice president, general counsel and secretary of International Flavors and Fragrances Inc., a leading creator, manufacturer and seller of flavors and fragrances (“IFF”) in December 2003, having been IFF’s chief legal officer since 1992. During his eleven years at IFF he also led the company’s Regulatory Affairs Department. Prior to 1992, Mr. Block served as senior vice president, general counsel, secretary and director of GAF Corporation, a company specializing in specialty chemicals and building materials, and its publicly traded subsidiary International Specialty Products Inc., held various management positions with Celanese Corporation, a company specializing in synthetic fibers, chemicals and plastics, and practiced law with the New York firm of Stroock & Stroock & Lavan. Mr. Block received his B.A. cum laude in Russian Studies from Yale University and his law degree from Harvard Law School. The Nominating and Corporate Governance Committee believes that Mr. Block’s experience as the chief legal officer of one of the world’s leading flavor and fragrance companies contributes to the Board’s understanding of the flavor industry, including the Board’s perspective on the strategic interests of potential collaborators, the regulation of the industry, and the viability of various commercial strategies. In addition, Mr. Block’s experience in the area of corporate governance and public company financial reporting is especially valuable to the Board in his capacity as a member of both the Audit Committee and the Compensation Committee.

Jeff Baxter,58, has served as a director of the Company since April 2015 and has served as a member of the Audit Committee and the Nominating and Corporate Governance Committee since April 2015. Mr. Baxter has served as President and CEO and a Director of VBI Vaccines, Inc. (NASDAQ:VBIV) since 2009. Previously, he was managing partner for the venture capital firm, The Column Group, where he played a pivotal role in the creation of several biotech companies including Immune Design Corp., a vaccine company based on the Lentiviral vector platform and TLR adjuvant technologies. Until July 2006, Mr. Baxter was SVP, R&D Finance and Operations, of GlaxoSmithKline (GSK). In his 19 years of pharma experience at GSK, he has held line management roles in R&D, commercial, manufacturing, finance and the office of the CEO. His most recent position in the global R&D organization included responsibility for finance, pipeline resource planning and allocation, business development deal structuring and SROne (GSK's in-house venture capital fund). He also chaired GSK's R&D Operating Board. Prior to GSK, he worked at Unilever and British American Tobacco. Mr. Baxter was educated at Thames Valley University and is a Fellow of the Chartered Institute of Management Accountants. The Nominating and Corporate Governance Committee believes that Mr. Baxter’s past experience in the pharmaceutical industry bring financial expertise, industry knowledge, and research and development experience to the Board.

Robert Fried, 60, became Chief Executive Officer in June 2018. He has served as a director of the Company since July 2015, President and Chief Operating Officer from January to June 2018 and President and Chief Strategy Officer from March 2017 to January 2018. Mr. Fried also served as a member of the Nominating and Corporate Governance Committee from July 2015 to March 2017. Mr. Fried has served as Chairman of the Board of Directors of Tiger Media, Inc., which is now Fluent, Inc. (NASDAQ: FLNT), an information solutions provider focused on data-driven digital marketing services, from 2011 until June 2015. From 2007 to 2017, Mr. Fried was the founder and Chief Executive Officer of Spiritclips LLC, now called Hallmark Movies Now, a subscription streaming video service, which was acquired by Hallmark Cards Inc. in 2012. Mr. Fried is an Academy Award winning motion picture producer whose credits include Rudy, Collateral, Boondock Saints, So I Married an Axe Murderer, Godzilla, and numerous others. From December 1994 until June 1996, he was President and Chief Executive Officer of Savoy Pictures, a unit of Savoy Pictures Entertainment, Inc. Mr. Fried has also held several executive positions including Executive Vice President in charge of Production for Columbia Pictures, Director of Film Finance and Special Projects for Columbia Pictures, and Director of Business Development at Twentieth Century Fox. Mr. Fried is a member of the Board of Directors of the Council for Responsible Nutrition and holds an M.S. from Cornell University and an M.B.A. from the Columbia University Graduate School of Business. The Nominating and Corporate Governance Committee believes that Mr. Fried’s past experience as Chairman of the Board of Directors of another public company brings financial expertise and industry knowledge to the Board.

Kurt A. Gustafson, 52, has been a director of the Company and Chair of the Audit Committee since October 2016 and a member of the Compensation Committee since March 2017. In April 2018, the Board of Directors appointed Mr. Gustafson as lead independent director of the Board of Directors. Mr. Gustafson has more than 25 years of diverse experience in corporate finance. He currently serves as chief financial officer, principal accounting officer and executive vice president of Spectrum Pharmaceuticals, Inc. (Nasdaq: SPPI). From 2009 to 2013, he served as the chief financial officer of Halozyme Therapeutics, Inc. (Nasdaq: HALO). From 1991 to 2009, Mr. Gustafson worked at Amgen Inc. (Nasdaq: AMGN), holding various financial roles as vice president finance, chief financial officer of Amgen International and treasurer. Prior to joining Amgen Inc., he worked in public accounting as staff auditor at Laventhol & Horwath in Chicago. Mr. Gustafson is currently a member of the Board of Directors of Xencor, Inc. (Nasdaq: XNCR), a clinical-stage biopharmaceutical company. Mr. Gustafson serves as Chair of Xencor, Inc.’s Audit Committee. Mr. Gustafson holds a Bachelors of Arts degree in Accounting from North Park University in Chicago and a Masters in Business Administration from University of California, Los Angeles. The Nominating and Corporate Governance Committee believes that Mr. Gustafson’s past experience as chief financial officer of a public company and his extensive experience pharmaceutical industry qualify him to chair the Audit Committee and that Mr. Gustafson brings financial, merger and acquisition experience, and a background working with public marketplaces to the Board.

Steven D. Rubin, 59, has been a director of the Company and a member of the Nominating and Corporate Governance Committee since March 2017 and Chair of Nominating and Corporate Governance Committee since March 2018. Mr. Rubin currently serves as OPKO Health, Inc.’s (NASDAQ: OPK) Executive Vice President – Administration since May 2007 and as a director since February 2007. Mr. Rubin is a member of The Frost Group, LLC, a private investment firm. He has extensive experience as a practicing lawyer, and as general counsel and board member to multiple public companies. Mr. Rubin currently serves on the board of directors for the following companies: Non-Invasive Monitoring Systems, Inc. (OTCBB:NIMU), a medical device company; Cocrystal Pharma, Inc. (OTCBB:COCP), a biotechnology company developing new treatments for viral diseases; Eloxx Pharmaceuticals (OTCMKTS: ELOX), a company committed to treating patients suffering from rare and ultra-rare diseases caused by premature termination codon (PTC) nonsense mutations, prior to its merger with Sevion Therapeutics in December 2017; Neovasc, Inc. (NASDAQ:NVCN), a company developing and marketing medical specialty vascular devices; and Red Violet, Inc., a software and services company that specializes in big data analysis providing cloud-based mission-critical information solutions to enterprises in a variety of industries. Red Violet, Inc. serves customers in the United States. Mr. Rubin previously served as the Senior Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006. Mr. Rubin previously served as a director of the following companies: Castle Brands, Inc. (NYSE:ROX), a developer and marketer of premium brand spirits; Kidville, Inc. (OTCBB:KVIL), an operator of large, upscale facilities, catering to newborns through five-year-old children and their families and offers a wide range of developmental classes for newborns to five-year-olds; VBI Vaccines Inc. (NASDAQ CM: VBIV), a commercial-stage biopharmaceutical company developing a next generation of vaccines; Dreams, Inc. (NYSE MKT: DRJ), a vertically integrated sports licensing and products company; Safestitch Medical, Inc. prior to its merger with TransEnterix, Inc.; and, PROLOR Biotech, Inc., prior to its acquisition by the Company in August 2013; and Cognit, Inc. (NASDAQ:COGT), a data and analytics company providing cloud-based mission-critical information and performance marketing solutions. The Nominating and Corporate Governance Committee believes that Mr. Rubin’s past experience as general counsel and board member of multiple public companies bring financial expertise, industry knowledge, and a background working with public marketplaces to the Board.

Wendy Yu, 44, has been a director of the Company since August 2017 and a member of the Nominating and Corporate Governance Committee since March 2018. Since 2012, Ms. Yu has served as the Chief Digital Officer of Horizons Digital Group Limited (affiliate of Horizons Ventures Limited, a Hong Kong based investment firm), overseeing the Asia expansion of Horizons’ portfolio companies and directing public relations, communications, marketing and events. Ms. Yu graduated from University of Toronto, majoring in Commerce and Psychology. Ms. Yu serves as the director nominated by Pioneer Step Holdings Limited pursuant to rights granted to Pioneer Step Holdings Limited pursuant to that certain Securities Purchase Agreement, dated April 26, 2017, by and among the Company and the certain purchasers named therein (the “April 2017 Purchase Agreement”). The Nominating and Corporate Governance Committee believes that Ms. Yu’s experience in management, marketing and communications bring valuable expertise to the Board.

Tony Lau, 31, has been a director of the Company since August 2017 and a member of the Compensation Committee since March 2018. Since September 2014, Mr. Lau has been with Horizons Ventures Limited, building the consumer and retail segment and China market of the Hong Kong based investment firm. Prior to joining Horizons Ventures Limited, Mr. Lau was with Goldman Sachs Asia from June 2011 to August 2014. Mr. Lau has a Bachelor of Arts degree in Finance from the Guanghua School of Management in Peking, China. Mr. Lau serves as the director nominated by Champion River Ventures Limited pursuant to rights granted to Champion River Ventures Limited pursuant to the April 2017 Purchase Agreement. The Nominating and Corporate Governance Committee believes that Mr. Lau’s experience in the finance and consumer products industry bring valuable experience to the Board.

2019 Director Compensation

Amended and Restated Director Compensation Policy

Under our Non-Employee Director Compensation Policy, each of our current non-employee directors is eligible to receive an annual retainer of $40,000 for serving on the Board and, if applicable, an additional annual retainer of $30,000 for serving as the Lead Independent Director. The chairpersons of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee receive an additional $20,000, $15,000, and $10,000, respectively, per year for service as chairperson for such committee. Members of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee each receive an additional $10,000, $7,500 and $5,000, respectively, per year for service on such committee.

Any non-employee director who is first elected to the Board will be granted an option to purchase 40,000 shares of our common stock on the date of his or her initial election to the Board. In addition, on the date of each annual meeting, each person who continues to serve as a non-employee member of the Board following such annual meeting will be granted a stock option to purchase 20,000 shares of our common stock. All option grants will have an exercise price per share equal to the fair market value of our common stock on the date of grant. Each initial grant for a non-employee director will vest over a three year period, and each annual grant for a non-employee director will vest over a one year period, in each case subject to the director’s continuing service on our Board.

The following table provides information concerning compensation of our non-employee directors who were directors during the fiscal year ended December 31, 2019. The compensation reported is for services as directors for the fiscal year ended December 31, 2019.

Director Compensation Table

| Name | Fees Earned or Paid in Cash ($) | | | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation($) | |

| | | | | | | | |

| Stephen Block (2) | 65,000 | - | 44,727 | - | - | - | 109,727 |

| Jeff Baxter (3) | 55,000 | - | 44,727 | - | - | - | 99,727 |

| Kurt Gustafson (4) | 97,500 | - | 44,727 | - | - | - | 142,227 |

| Steven Rubin (5) | 50,000 | - | 44,727 | - | - | - | 94,727 |

| Wendy Yu (6) | 45,000 | - | 44,727 | - | - | - | 89,727 |

| Tony Lau (7) | 47,500 | - | 44,727 | - | - | - | 92,227 |

(1) The amounts in the column titled “Option Awards” above reflect the aggregate grant date fair value of stock option awards for the fiscal year ended December 31, 2019. See Note 14 of the ChromaDex Corporation Consolidated Financial Report included in the Form 10-K for the year ended December 31, 2019, filed with the SEC on March 10, 2020, for a description of certain assumptions in the calculation of the fair value of the Company’s Proxy Materials.stock options. The options have an exercise price of $3.80 and vest 100% on June 21, 2020. Any appropriate proposal submitted

(2) On June 21, 2019, Mr. Block was awarded the option to purchase 20,000 shares of the Company’s common stock.

(3) On June 21, 2019, Mr. Baxter was awarded the option to purchase 20,000 shares of the Company’s common stock.

(4) On June 21, 2019, Mr. Gustafson was awarded the option to purchase 20,000 shares of the Company’s common stock.

(5) On June 21, 2019, Mr. Rubin was awarded the option to purchase 20,000 shares of the Company’s common stock.

(6) On June 21, 2019, Ms. Yu was awarded the option to purchase 20,000 shares of the Company’s common stock.

(7) On June 21, 2019, Mr. Lau was awarded the option to purchase 20,000 shares of the Company’s common stock.

Family Relationships

There are no family relationships between any of our directors and executive officers.

Involvement in Certain Legal Proceedings

During the past ten years, none of our officers, directors, promoters or control persons have been involved in any legal proceedings as described in Item 401(f) of Regulation S-K.

VOTE REQUIRED

Under applicable Delaware law, the election of each nominee requires the affirmative vote by a plurality of the voting power of the shares present and entitled to vote on the election of directors at the Annual Meeting at which a quorum is present.

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES NAMED ABOVE AS DIRECTORS, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

The Board has established a corporate Code of Business Conduct and Ethics that applies to all officers, directors and employees and which is intended to qualify as a “code of ethics” as defined by Item 406 of Regulation S-K of the Exchange Act. The Code of Business Conduct and Ethics is available on the Investor Relations section of the Company’s website at www.chromadex.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

Public Availability of Corporate Governance Documents

Our key corporate governance documents, including our Code of Conduct and the charters of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are:

●

available on the Investor Relations section of our corporate website at www.chromadex.com; and

●

available in print to any stockholder who requests them from our corporate secretary.

Director Attendance

The Board held four meetings during 2019. Each director attended at least 75% of Board meetings and meetings of the committees on which he or she served.

Board Qualification and Selection Process

The Nominating and Corporate Governance Committee does not have a specific written policy or process regarding the nominations of directors, nor does it maintain minimum standards for director nominees or consider diversity in identifying nominees for director. However, the Nominating and Corporate Governance Committee does consider the knowledge, experience, integrity and judgment of potential candidates for nominations to the Board. The Nominating and Corporate Governance Committee will consider persons recommended by stockholders for nomination for election as directors. The Nominating and Corporate Governance Committee will consider and evaluate a director candidate recommended by a stockholder in the same manner as a committee-recommended nominee. Stockholders wishing to recommend director candidates must follow the prior notice requirements as described herein.

Board Leadership Structure and intendedRisk Oversight

The leadership of the Board of Directors is currently structured so that it is led by an Executive Chairman, Frank Jaksch, who has authority, among other things, to call and preside over meetings of the Board of Directors, to set meeting agendas and to determine materials to be presented at the 2016 Annual Meeting must be submitted in writingdistributed to the Company’s Secretary at 10005 Muirlands Blvd, Suite G, Irvine, CA 92618,Board of Directors. As Executive Chairman, Mr. Jaksch will serve as Chairman of the Board and received no later than December 13, 2016,will continue to be includableserve as an employee and executive officer of the Company. Kurt Gustafson serves as lead independent director.

The Board of Directors has determined that the leadership structure, in which there is an Executive Chairman and an independent director acting as lead independent director, ensures that the appropriate level of oversight, independence, and responsibility is applied to all Board decisions, including risk oversight, and is in the best interests of the Company and those of the Company’s Proxy Statementstockholders. The lead independent director serves as the liaison between the Executive Chairman and related proxythe independent directors and his responsibilities, among other things, include facilitating communication with the Board and presiding over regularly conducted executive sessions of the independent directors and establishing the agenda for meetings of the independent directors. The Board of Directors believes that its strong corporate governance policies and practices, including the substantial percentage of independent directors on the Board of Directors, and the robust duties that will be delegated to the lead independent director, empower the Board of Directors to effectively oversee the Company’s Chief Executive Officer and Executive Chairman and provide an effective and appropriately balanced Board of Directors governance structure.

The entire Board of Directors, as well as through its various committees, is responsible for oversight of our Company’s risk management process. Management furnishes information regarding risk to the Board of Directors as requested. The Audit Committee discusses risk management with the Company’s management and independent public accountants as set forth in the Audit Committee’s charter. The Compensation Committee reviews the compensation programs of the Company to make sure economic incentives are tied to the long-term interests of the stockholders. The Company believes that innovation and the building of long-term stockholder value are impossible without taking risks. We recognize that imprudent acceptance of risk and the failure to identify risks could be a detriment to stockholder value. The executive officers of the Company are responsible for assessing these risks on a day-to-day basis and for how to best identify, manage and mitigate significant risks that the Company may face.

Board Committees

The Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Other committees may be established by the Board from time to time. The following table provides membership and meeting information for the 2017 Annual Meeting. A stockholder proposal will need to comply fiscal year ended December 31, 2019 for each of our Board committees:

| Name | | Audit | | Compensation | | Nominating and Corporate Governance |

| Jeff Baxter | | X | | | | X |

| Stephen Block | | X | | X(1) | | |

| Kurt Gustafson | | X(1) | | X | | |

| Tony Lau | | | | X | | |

| Steven Rubin | | | | | | X(1) |

| Wendy Yu | | | | | | X |

| Total meetings in fiscal year ended December 31, 2019 | | 5 | | 5 | | 3 |

(1)

Committee Chairperson.

The following is a description of each of the committees and their composition:

Audit Committee

The Audit Committee of the Board of Directors was established by the Board of Directors in accordance with the SEC regulations under Rule 14a-8Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions, including, among other things:

●

evaluates the performance of and assesses the qualifications of the independent auditors;

●

determines and approves the engagement of the independent auditors;

●

determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors;

●

reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services;

●

monitors the rotation of partners of the independent auditors on the Company’s audit engagement team as required by law;

●

reviews and approves or rejects transactions between the company and any related persons;

●

confers with management and the independent auditors regarding the inclusioneffectiveness of stockholder proposalsinternal control over financial reporting;

●

establishes procedures, as required under applicable law, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters; and

●

meets to review the Company’s annual audited financial statements and quarterly financial statements with management and the independent auditor, including a review of the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The Audit Committee currently consists of three directors: Kurt Gustafson (chairman), Stephen Block and Jeff Baxter. The Audit Committee met five times during the last fiscal year. The Board of Directors has adopted a written Audit Committee charter that is available to stockholders on the Investor Relations section of the Company’s website at www.chromadex.com. The information on our website is not incorporated by reference into this Proxy Statement or our Annual Report for fiscal year 2019.

The Board of Directors reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Audit Committee are independent (as independence is currently defined in company-sponsored proxy materials. AlthoughRule 5605(c)(2)(A) of the NASDAQ listing standards and Rule 10A-3 of the Exchange Act).

The Board of Directors has also determined that Mr. Gustafson also qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Gustafson’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for public reporting companies.

Report of the Audit Committee of the Board of Directors

This report of the audit committee is required by the SEC and, in accordance with the SEC's rules, will consider stockholder proposals, we reservenot be deemed to be part of or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the right to omit from our Proxy Statement,Securities Act, or to vote against, stockholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8.except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed "soliciting material" or "filed" under either the Securities Act or the Exchange Act.

Requirements

The Audit Committee has reviewed and discussed the audited financial statements for Stockholder Proposalsthe fiscal year ended December 31, 2019 with management of the Company. The Audit Committee has discussed with the Company’s independent registered public accounting firm the matters required to Be Brought Beforebe discussed by the 2017 Annual Meetingapplicable requirements of Stockholdersthe Public Company Accounting Oversight Board (“PCAOB”) and Director Nominations. Stockholders intendingthe SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to present a proposal at the 2017 Annual MeetingBoard of Stockholders but not intending to haveDirectors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

The Audit Committee of

Kurt Gustafson (Chairman)

Stephen Block

Jeff Baxter

Compensation Committee

Our Compensation Committee currently consists of three directors: Stephen Block (chairman), Kurt Gustafson and Tony Lau. All members of the Compensation Committee are independent (as independence is currently defined in Rule 5605(d)(2) of the NASDAQ listing standards. The Compensation Committee met five times during fiscal year 2019. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Investor Relations section of the Company’s website at www.chromadex.com. The information on our website is not incorporated by reference into this Proxy Statement or our Annual Report for fiscal year 2019.

The Compensation Committee acts on behalf of the Board to review, modify (as needed) and formapprove the Company’s compensation strategy, policies, plans and programs. For this purpose, the Compensation Committee performs several functions, including, among other things:

●

establishment of proxy relatingcorporate and individual performance objectives relevant to the 2017 annual meetingcompensation of stockholders, as well as any director nominations, must submit such proposalsthe Company’s executive officers and evaluation of performance in light of these stated objectives;

●

review and approval (or recommend to ChromaDex Corporation, ATTN:the Board of Directors for approval) of the compensation and other terms of employment or service, including severance and change-in-control arrangements, of the Company’s Chief Executive Officer, 10005 Muirlands Blvd, Suite G, Irvine, CA 92618, no earlierother executive officers and non-employee directors; and

●

administration of the Company’s equity compensation plans, pension and profit-sharing plans, deferred compensation plans and other similar plan and programs.

If applicable, the Compensation Committee will review with management the Company’s Compensation Discussion and Analysis and will consider whether to recommend that it be included in proxy statements and other filings.

The Compensation Committee has the authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. In March 2018, the Compensation Committee retained a consulting firm, Exequity LLP (“Exequity”) directly, although in carrying out assignments, the consulting firm may interact with Company management when necessary and appropriate. Exequity is a nationally recognized provider of executive compensation advisory services and was deemed independent pursuant to SEC rules.

The Compensation Committee generally does not have a specific target amount of compensation for individual executive officers relative to a peer group of companies, but it considers peer data for purposes of assessing the competitiveness of the executive compensation program. An individual executive officer may earn more or less than March 4, 2017the market median depending on factors described below, including the individual’s experience and no later than April 3, 2017.background, role, and past and future performance.

What Interest DoThe Company has paid and will pay cash bonuses to its executive officers in 2020 for 2019 performance based upon achievements of certain goals. For additional information regarding the performance bonus amounts, see “Executive Officers and Directors Have in Matters to Be Acted Upon?Management Compensation.”

MembersCompensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is an officer or employee of the Company. None of the executive officers currently serves, or in the past year has served, as a member of the board of directors andor compensation committee of any entity that has one or more executive officers serving on the Board or Compensation Committee.

Compensation Committee Report

This report of the Compensation Committee is required by the SEC and, in accordance with the SEC's rules, will not be deemed to be part of or incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended (“Securities Act”), or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and will not otherwise be deemed "soliciting material" or "filed" under either the Securities Act or the Exchange Act.

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis contained in this proxy statement with management. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

Submitted by:

The Compensation Committee of

The Board of Directors

Stephen Block, Chairman

Kurt Gustafson

Tony Lau

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of three directors: Steven Rubin (chairman), Jeff Baxter and Wendy Yu. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQ listing standards). The Nominating and Corporate Governance Committee met three times during the last fiscal year. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Investor Relations section of the Company’s website at www.chromadex.com. The information on the website is not incorporated by reference into this Proxy Statement or the Annual Report for fiscal year 2019.

The Nominating and Corporate Governance Committee is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company do not have any interest in any other Proposal that is not sharedconsistent with criteria approved by all other stockholdersthe Board of Directors, reviewing and evaluating incumbent directors, selecting or recommending to the Board of Directors for selection candidates for election to the Board of Directors, making recommendations to the Board of Directors regarding the membership of the Company, other than Proposal 1, the election to our boardcommittees of the seven nominees set forth herein.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT